Your Investment Today

One-time payment • Lifetime access

Today's Price:

One-time payment • No recurring fees

Secure Checkout • 30-Day Money-Back Guarantee

256-Bit SSL Encrypted Ko-Fi Checkout

The exact 3-phase career roadmap that helped 14,000+ students land jobs at Microsoft, Google, and Amazon. Get job-ready with practical frameworks you can use Monday morning.

Join 14,000+ Students • 30-Day Guarantee • No Questions Asked

100% Risk-Free • Full Refund if Not Satisfied

100% Risk-Free • Full Refund if Not Satisfied

"Landed my Scrum Master role 6 weeks after completing the course. $28K salary increase."

Bonus: Includes my investment book Little Leaks... (a $19 value) at no extra cost.

Limited Time Discount • Act Fast

Watch this 2-minute overview to see exactly what you're getting and how it will transform your career

Join 14,000+ Students • 30-Day Guarantee • No Questions Asked

Trusted by professionals at

Overwhelmed by 25 courses? Start here. These proven paths take you from beginner to hired in 6 weeks.

Perfect if you're new to Scrum or changing careers

Already know the basics? Master advanced skills employers pay premium for

Ready to lead multiple teams? Command $150K+ salaries

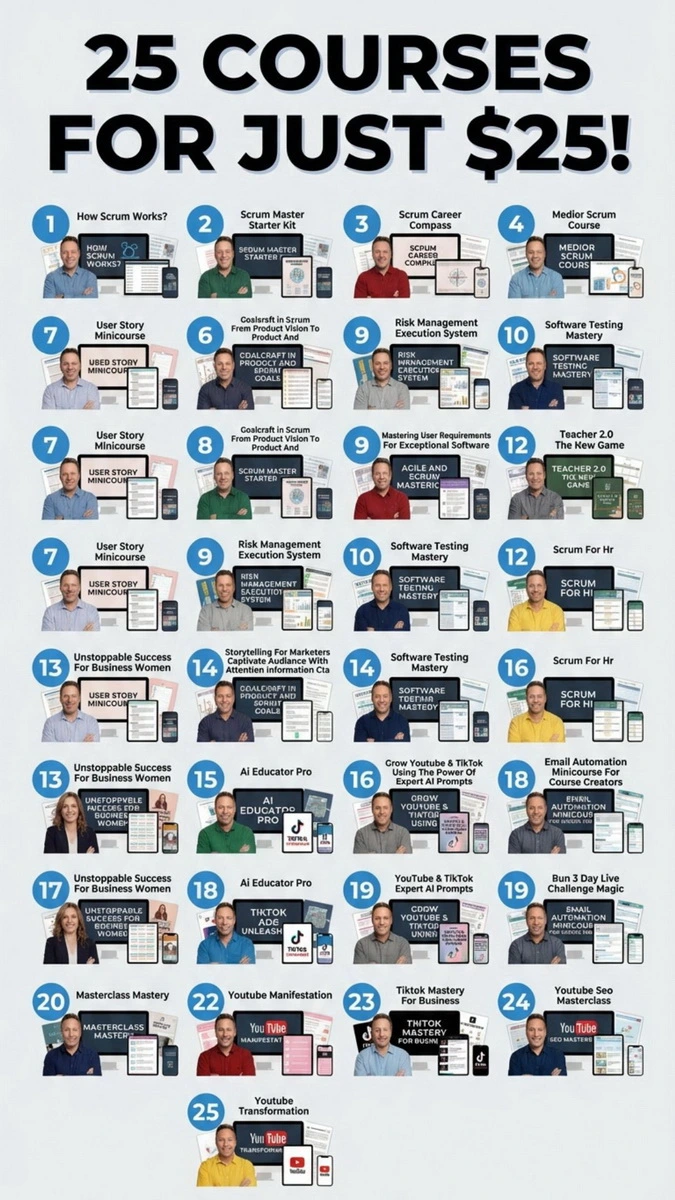

Complete career transformation system – normally sold separately for $3,725+

13 Scrum + 12 Marketing/Sales courses for independent consulting

Sprint plans, retrospectives, user stories, risk assessments

Resume templates, interview prep, LinkedIn optimization

PSM & PSPO exam strategies and practice questions

Microsoft, Google, Amazon implementation examples

14,000+ member network for support and connections

Risk management, requirements engineering, testing strategies

All future course updates and new content — free forever

Start as a beginner, finish as a certified expert – with clear milestones every step of the way

Weeks 1-2 (10-15 hours)

Run your first Sprint, facilitate Scrum ceremonies, and confidently talk about Agile in job interviews

Weeks 3-4 (15-20 hours)

Write perfect user stories, manage product backlogs, assess project risks, and pass PSM I/PSPO I exams

Weeks 5-6 (10-15 hours)

Scale Agile across organizations, lead coaching engagements, and build a $5K-$15K/month consulting practice

Join thousands who transformed their careers in weeks, not years

"I landed my Scrum Master role at a Fortune 500 company just 6 weeks after completing Phase 1. The interview prep templates were exactly what I needed."

"Passed my PSM I certification on the first attempt with 95%. The exam prep course in Phase 2 covered every question type I saw on the real test."

"Zero tech background to Product Owner in 3 months. The User Story Mastery course taught me frameworks my colleagues still don't know. Best $25 I ever spent."

"Used Phase 3 to launch my Agile consulting business. Now I'm working with 3 clients at $4K/month each. The marketing courses were pure gold."

Compare what you get vs. traditional Scrum training options

| What You Get | This Bundle $25 |

Scrum.org $150-$500 |

Udemy Courses $80-$200 |

Bootcamps $2,000+ |

|---|---|---|---|---|

| Complete Courses | 25 courses | 1-3 courses | 5-8 courses | 8-12 courses |

| Lifetime Access | 12-Month Access | |||

| Templates & Frameworks | Limited | Limited | ||

| Business & Marketing Skills | ||||

| Free Updates | ||||

| Community Access | 14,000+ members | Limited | Q&A only | Alumni only |

| Career Support | ||||

| Total Value | $3,725 | $150-$500 | $400-$800 | $2,000+ |

Why pay more for less? Get everything you need for just $25.

One-time payment • Lifetime access

Today's Price:

One-time payment • No recurring fees

Secure Checkout • 30-Day Money-Back Guarantee

256-Bit SSL Encrypted Ko-Fi Checkout

Try everything. Use the templates. Join the community. If within 30 days you don't use at least one template that saves you time or makes you money, email us for a full refund. No questions. No forms. No hassle.

Email me within 30 days with "Refund Request" in subject line. We process 100% refunds within 24-48 hours, no questions asked.

We only want your money if you're getting results.

No! Phase 1 is designed for absolute beginners. We start from "What is Scrum?" and build up systematically. If you can use email and watch videos, you can master this.

Most students finish Phase 1 (job-ready foundation) in 2 weeks working 5-7 hours per week. The full 3-phase system takes 6-8 weeks. But you have lifetime access, so go at your own pace - no deadlines, no pressure.

This is a volume experiment. I make my primary income from enterprise consulting - not from selling courses at $200. I'd rather have 1,000 people implement these systems at $25 than 25 people buy one course at $200. You get an insane deal, I get testimonials and case studies. Win-win.

Yes. You pay once and own the courses forever. This includes all future updates to these specific courses. No recurring fees, no surprise charges.

Both! Phase 1 is designed for absolute beginners to get job-ready, while Phases 2-3 offer advanced strategies for professionals. The 3-phase structure means you know exactly where to start based on your current level.

Perfect! Most people focus on the 13 core Scrum courses first. At $25 for everything, it's cheaper than buying even ONE course individually ($150-$200 each). The bonus marketing courses are there if you ever want to freelance or consult - just ignore them if you don't need them.

Yes, you receive a certificate of completion for each course you finish. These can be added to your LinkedIn profile and resume. While they're not official certifications like PSM or PSPO, they demonstrate your commitment to learning and skill development.

Simple: 30-day money-back guarantee. Try everything. Use the templates. If within 30 days you don't find value, email me for a full refund. No questions asked, no complicated forms. We only want your money if you're getting results.

When you click "Get Instant Access," you'll be taken to our secure checkout on Ko-fi (trusted by over 1 million creators). You can pay with any major credit card, PayPal, or Apple Pay. The process takes about 60 seconds. After payment, you'll receive an email with your login credentials within minutes.

MA in Computer Science & IT

20+ Years Industry Experience

Certified Scrum Master & Product Owner

14,000+ Students in 35+ Countries

"I created this bundle because I remember being broke, confused, and overwhelmed by expensive certifications that promised everything but delivered nothing practical.

After 20 years leading IT teams and training professionals at companies like Microsoft and Google, I realized: people don't need more theory, they need frameworks and systems they can use Monday morning.

This $25 bundle is my way of giving everyone access to what used to cost thousands. If just one template helps you land a job, save a project, or grow your business, I've done my job."

Featured in courses used by professionals at Microsoft, Adobe, Yahoo, Spotify, Toyota, IBM, Amazon, and Google.

The Scrum Career Compass alone sells for $150. User Requirements is $200.

You're getting the complete 13-course training system for $25.

Most software projects fail because of unclear requirements, not bad code.

The User Requirements course teaches frameworks that prevent costly rework - often worth tens of thousands per project.

Is $25 really the risk here?

⚡ Volume Experiment • Instant access • 30-day guarantee